Perfect storm creates shortage of warehouses

Posted on October 14, 2020

Source: Stuff Source link: http://www.stuff.co.nz/perfect-storm-creates-shortage-of-warehouses Written by: Catherine Harris

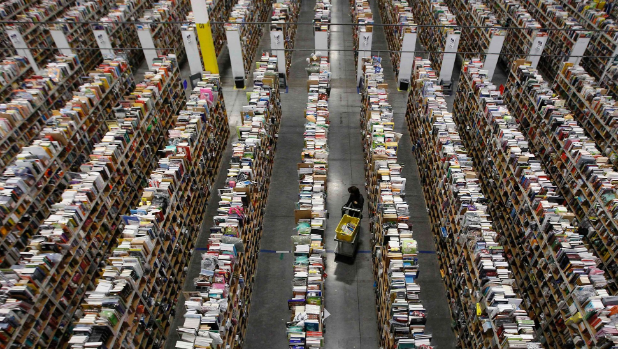

A country-wide lack of industrial property has left the booming warehousing sector with simply not enough space.

Strong economic growth and the high cost of building new warehouses have seen industrial vacancy rates plunge to record lows.

Aaron Young, managing director of Storepro, one of the country’s largest pallet racking suppliers, is very connected to the warehousing sector and says it is the tightest market he had seen in his 19 years in the industry.

“Basically there’s nothing to buy, there’s very few to lease, the market’s very tight in terms of [being] owned by predominantly big landlords.”

He estimated that in the last three years, Auckland warehouse land values had gone up by 30 per cent, with rent on its coat-tails. The high price of warehouse properties was being made worse by baby boomers looking for higher returns, who had turned to industrial property.

“They’re pretty happy to accept a pretty lean yield in the 5 per cent range, which has now become the norm.”

Building new was also prohibitive, with Goodman Trust’s chief executive John Dakin estimating recently that the average cost of building a warehouse in Auckland had risen about 50 per cent compared to five years ago.

The warehousing shortage is nation-wide but particularly acute in Auckland, boosted by the growth of large-scale logistics and freight forwarding businesses.

Colliers national research director Alan McMahon said demand had really ramped up over the last three or four years and even new speculative buildings were not keeping up with demand.

“In Auckland there’s about 12 million square metres of industrial property, and that’s warehousing and manufacturing basically, and at the moment the vacancy rate is 2.4 per cent, which is the lowest it’s ever been, since 1995 when we started measuring it.”

Prime industrial space had slid to a historic low of 1.7 per cent, with secondary at 2.7 per cent. And it was a similar story in Wellington and Christchurch.

For warehouse owners, the shortage bodes well for rental income. McMahon said speculative builders was doing well out of the situation, but the lag in supply would inevitably push up rents.

Economic growth, particularly in logistics and consumer spending, was behind it.

“If you look at the correlation between economic activity, things like business starts, truck movements … it’s very closely correlated with demand for property.”

The rapid growth of online shopping was creating huge demand for warehousing.

“In the UK, 65 per cent last year of all warehousing leases were from retailers. It’s a much smaller percentage here but it’s a growing trend, for sure.”

Young said Auckland’s traffic was a major issue, with a constant debate about how far out distribution should move away from its customers.

“Not so much in Christchurch or Palmerston North or even Hamilton, but in Auckland there’s an infrastructure transport issue behind the scenes. So time from warehouse to store as such has probably tripled in the last five years in Auckland, it takes that much longer to do anything.”

From business parks in areas like Pokeno on the outskirts of Auckland, there was only a small window of opportunity to get across town. “That window might be between 10.30am and 2.30pm so you’re really working to a four-hour transport run.”

The unitary plan had also had an impact, as residential development crept into industrial zones and pushed industry to the fringes.

“Mount Wellington and Penrose used to be traditional industrial. Now it’s probably half residential and then you’ve got a lot of service type industries within that area, which might be electricians or plumbers.”

In the long-term, Young said driverless trucks might help, with hopefully better infrastructure.

“It doesn’t matter how far effective the warehouse or distribution centres might be in north Auckland or south Auckland, if they can’t get product through to the stores.”

However, another international trend towards taller warehouses with robotic stackers was less likely because of our building code.

“You’ll quite commonly see warehousing at 40-50 metres high. We’re not going to see that here because of the fire codes and seismic codes.”

The one good thing about the squeeze was that it was forcing people to be more economical with their space, Young said.

“They can’t just simply go down the road or move elsewhere because there is just not that option.” As a storage solutions company, “that’s good for us.”

The big crunch

* In Auckland 100,000sqm of new industrial building is underway

* But Colliers estimates the city needs to double that to 200,000sqm of new supply every year.

* Some of the “speculative” buildings – without any tenant commitment – are being constructed by Goodman Property Trust at its Highbrook business park in Auckland’s East Tamaki. Its industrial portfolio is completely full.

* Vacancy rates for industrial space in Wellington is at its lowest for eight years, at 2.9 per cent.

* Christchurch vacancy is also at its lowest since 2009 at 1.9 per cent, but new stock is on the way, largely purpose-built facilities.

– Stuff

News

News